Eb5 Immigrant Investor Program for Dummies

Table of ContentsThe Single Strategy To Use For Eb5 Immigrant Investor ProgramThe Of Eb5 Immigrant Investor ProgramTop Guidelines Of Eb5 Immigrant Investor ProgramSee This Report on Eb5 Immigrant Investor ProgramThe Best Strategy To Use For Eb5 Immigrant Investor ProgramThe Definitive Guide to Eb5 Immigrant Investor Program

Despite being less popular, various other pathways to getting a Portugal Golden Visa include investments in equity capital or exclusive equity funds, existing or new company entities, resources transfers, and donations to sustain clinical, technological, artistic and social developments. Holders of a Portuguese resident permit can also work and examine in the country without the requirement of obtaining added authorizations.

Eb5 Immigrant Investor Program Can Be Fun For Everyone

Financiers need to have both a successful business background and a substantial business performance history in order to apply. They may include their spouse and their youngsters under 21-years- old on their application for long-term home. Effective applicants will certainly get a sustainable five-year reentry license, which enables for open travel in and out of Singapore.

.jpg)

The 25-Second Trick For Eb5 Immigrant Investor Program

Candidates can invest $400,000 in federal government authorized genuine estate that is resalable after 5 years. Or they can invest $200,000 in government authorized real estate that is resalable after 7 years. All while paying federal government charges. Or they can contribute $150,000 to the government's Lasting Growth Fund and pay lower government fees.

This is the primary benefit of arriving to Switzerland compared to various other high tax nations. In order to be eligible for the program, candidates need to Be over the age of 18 Not be employed or inhabited in Switzerland Not have Swiss citizenship, it needs to be their first time staying in Switzerland Have actually rented out or purchased home in Switzerland Supply a long listing of recognition records, consisting of clean criminal record and good ethical personality It takes about after repayment to get a resident authorization.

Rate 1 visa holders stay in condition for concerning three years (depending on where the application was submitted) and should use to extend their remain if they wish to proceed living in the United Kingdom. The Tier 1 (Business Owner) Visa is valid for 3 years and 4 months, with the alternative to extend the visa for an additional two years.

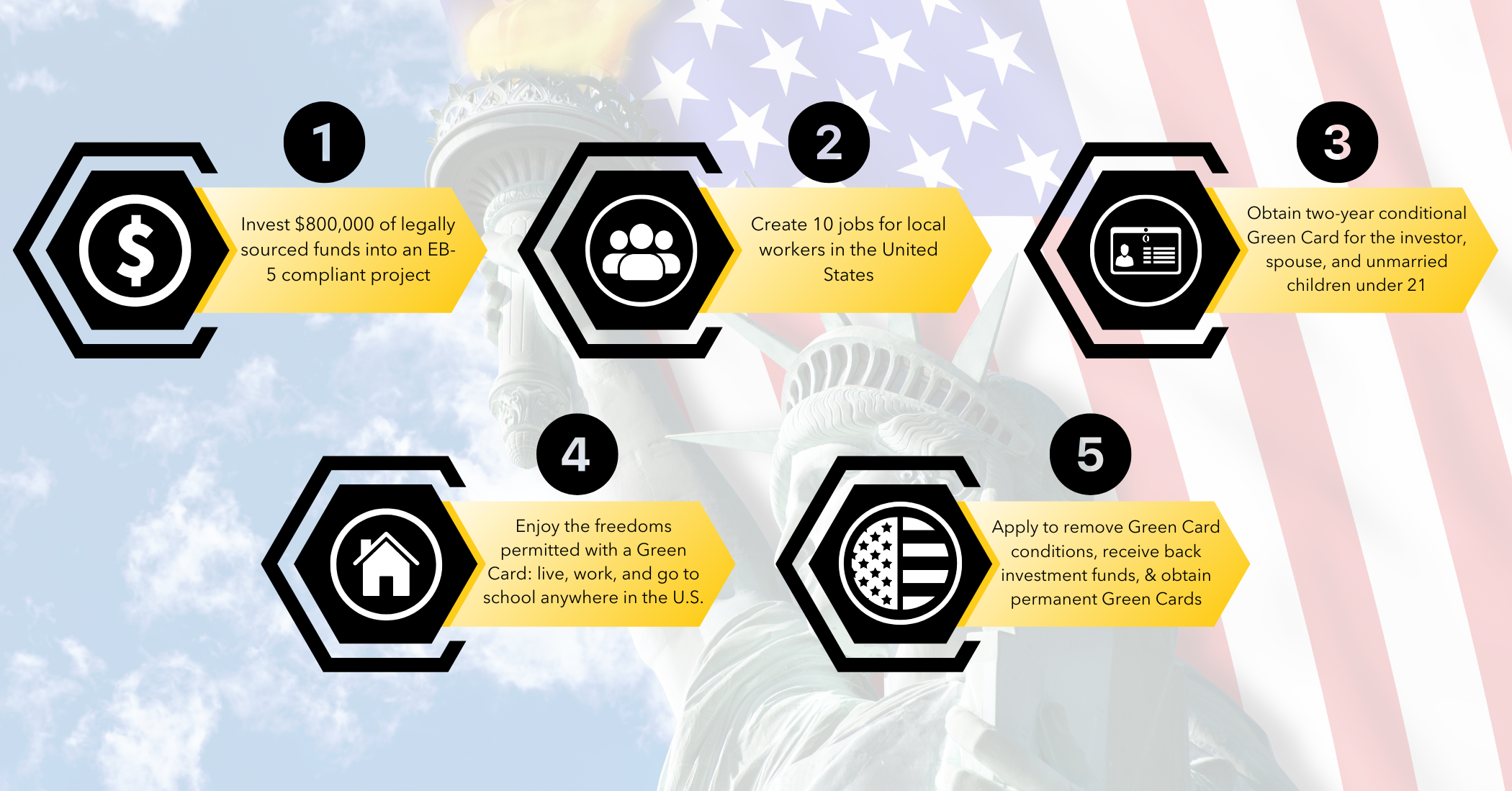

Financial investment migration has been on a higher pattern for greater than 2 decades. The Immigrant Financier Program, additionally known as useful content the EB-5 Visa Program, was developed by the U.S. Congress in 1990 under the Immigration Act of 1990 or IMMACT90. Its key objective: to promote the U.S. economic climate through work creation and capital expense by foreign financiers.

This consisted of decreasing the minimum financial investment from $1 million to $500,000. With time, adjustments have actually increased the minimum financial investment to $800,000 in TEAs and $1.05 million in other locations. In 1992, Congress sought to boost the effect of the EB-5 program by presenting the Regional Facility Pilot Program. These privately-run entities were designated to advertise economic development and task development within specific geographical and sector markets.

Indicators on Eb5 Immigrant Investor Program You Should Know

Developers in rural areas, high joblessness locations, and infrastructure projects can profit from a committed swimming pool of visas. Financiers targeting these certain areas have an increased probability of visa availability.

Developers servicing public jobs jobs can now get approved for EB-5 click to investigate funding. Investors currently have the chance to spend in government-backed facilities jobs. Specific USCIS analyses under prior law are locked in by law, consisting of forbidden redemption and debt arrangements, and gifted and loaned mutual fund. Developers need to ensure their financial investment arrangements adhere to the brand-new statutory interpretations that affect them under U.S.

migration law. EB5 Immigrant Investor Program. Financiers must be conscious of the approved types of mutual fund and setups. The RIA has developed demands for concerns such as redeployment, unlike prior to in prior versions of the regulation. Financiers and their family members already legitimately in the U.S. and eligible for a visa number might concurrently submit applications for change of status along with or while awaiting adjudication of the capitalist's I-526 request.

This simplifies the process for investors currently in the U.S., quickening their capability to change condition and avoiding consular visa handling. Capitalists looking for a quicker handling Resources time might be more likely to invest in country projects.

How Eb5 Immigrant Investor Program can Save You Time, Stress, and Money.

Looking for united state federal government details and services?

To qualify, applicants need to spend in new or at-risk business enterprises and develop permanent placements for 10 certifying workers. The United state economy advantages most when a location is at danger and the new financier can provide a working establishment with complete time work.

TEAs were carried out into the financier visa program to urge investing in locations with the best need. TEAs can be rural locations or areas that experience high joblessness.